Measuring Impact using Client Surveys 2005 & 2008

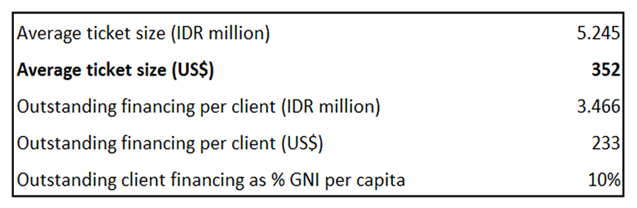

Targeting is an important strategy for reaching the poor in the first place. In MBK, all clients are women. Some 75 percent of these clients came from low-income families below the official poverty line, as estimated by (a) the modified CASHPOR housing index, and (b) per capita income below the official poverty line. The average outstanding ticket size of MBK clients was around Rp 5 million ($352) in July 2022, or 10% percent of Indonesia’s per capita Gross National Income of $3,870 in that year.

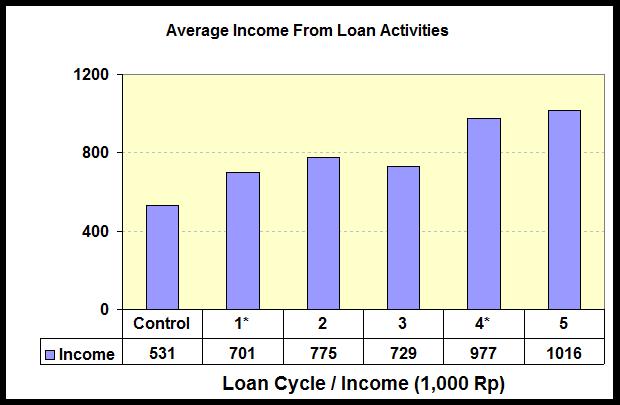

To monitor and evaluate MBK’s impact on income, poverty and living standards, MBK commissioned two client surveys from the Business School of the State University of California, Northridge. The first survey was undertaken in 2005 and the second in 2008. The results of the more recent study are briefly summarized below, involving 287 clients selected randomly and 201 control respondents. The average income of clients increased by 22 percent between working capital cycle one and two, and again by 23 percent between cycle three and four (figure 1).

Figure 1. Average Income from Working Capital Activities, 2008

Source: “Assessing the Impact of Mitra Bisnis Keluarga (MBK)”, Richard W. Moore, Business School of the State University of California, Northridge, 2010.

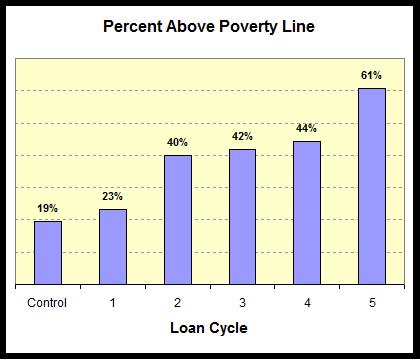

Poverty incidence also improved substantially in this period. The number of persons above the poverty line increased from around 20 percent to 61 percent between the first and fifth cycle in the programme (figure 2).

Figure 2. Percentage of Clients above the Poverty Line, 2008

Source: Same as figure 1

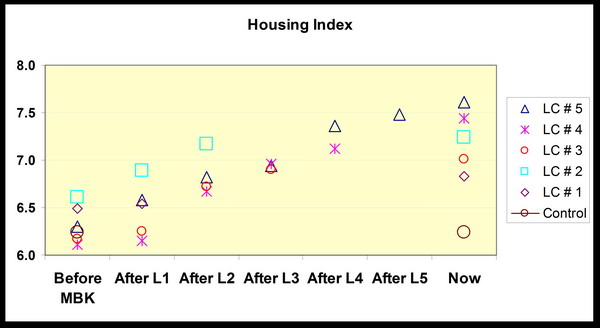

The housing status of the clients showed marked improvement between cycle 1 and cycle five as shown in the graph below (figure 3).

Figure 3. Trends in Modified CASHPOR Housing Index

Source: Same as figure 1

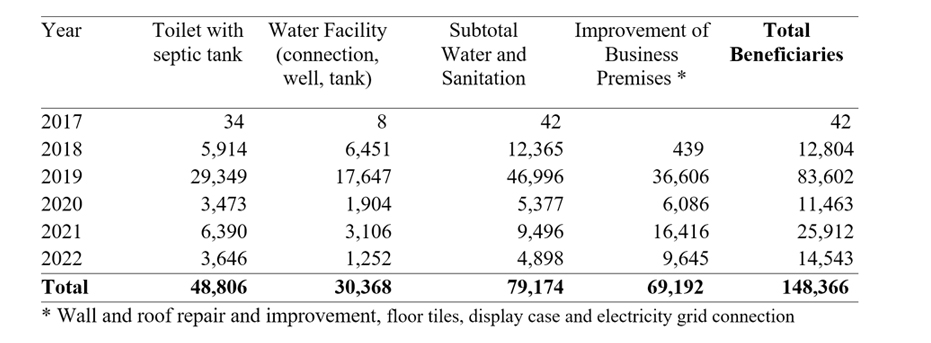

Direct Impact on Beneficiaries

Starting in 2017, MBK introduced a comprehensive range of water and sanitation products. This was followed in 2018 by the provision of financing for improvement of business premises. As of June 2022, some 150,000 MBK clients took advantage of these novel products to improve their homes in terms of better facilities and hygiene. Of these, some 70,000 clients improved their business premises to attract more customers.